CASE STUDY

Fintech Transaction & Payment Management Software: Transforming Digital Banking.

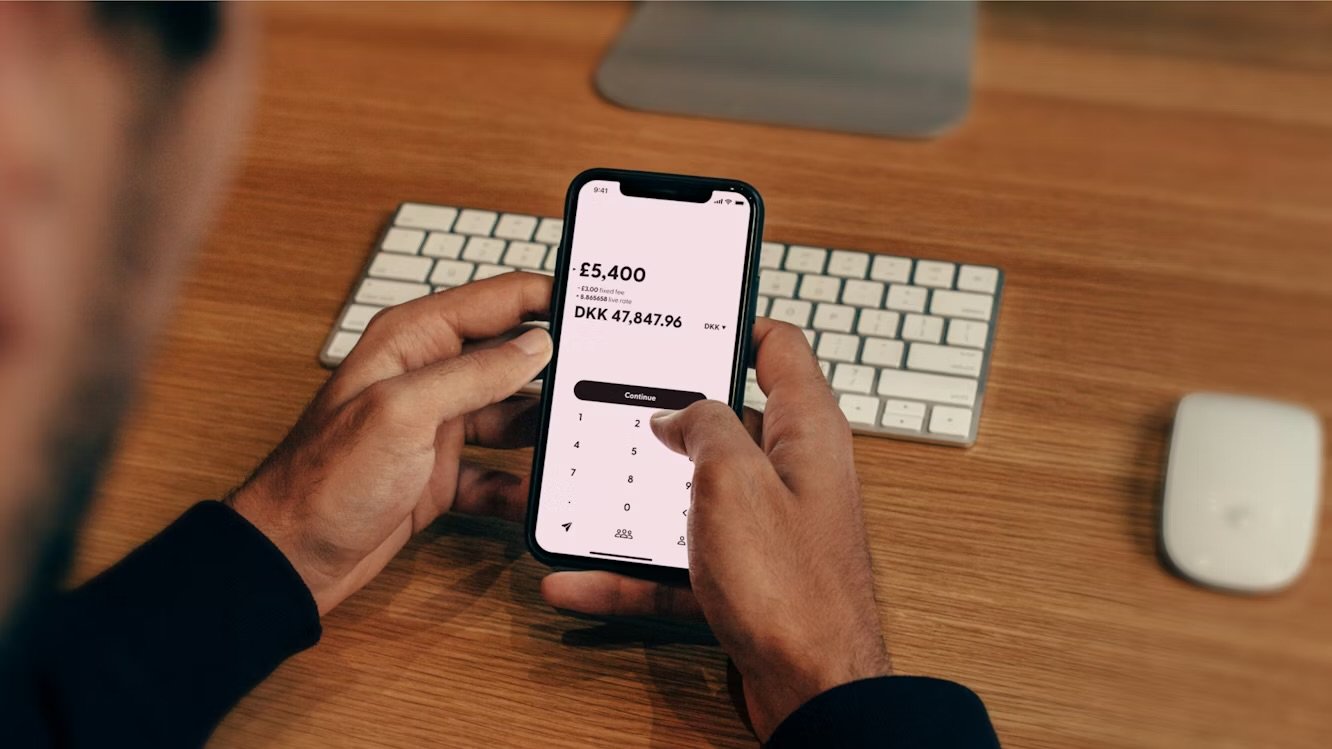

Koldatech developed a robust Fintech Transaction & Payment Management Platform that enabled a digital banking provider to streamline payment processing, improve security, enhance user experience, and scale their operations efficiently. The platform addressed critical pain points in transaction management while ensuring compliance with regulatory standards, ultimately enabling the client to expand their customer base and grow revenue in a competitive digital banking market.

Client

The client is a rapidly growing digital banking startup providing a suite of financial services to individuals and small businesses.

Their services included online account management, peer-to-peer payments, bill payments, and merchant solutions. Despite strong growth and high user adoption, the client faced significant operational challenges due to outdated legacy systems and manual processes. These limitations hindered their ability to scale effectively, respond to compliance requirements, and provide a seamless user experience. The organization recognized the need for a modern, scalable, and secure fintech platform capable of handling large volumes of transactions in real time. Their vision was to create a system that not only processed payments efficiently but also offered robust security, integrated analytics, and a frictionless customer experience across web and mobile applications.

Problem

Challenges in Fintech Operations

Before partnering with Koldatech, the client faced several operational and technical hurdles that directly impacted growth and customer satisfaction. Manual Transaction Monitoring: Many of the client’s transaction workflows relied on manual checks and reconciliations, which slowed down operations and increased the likelihood of errors. Transactions often required multiple staff members to verify payments, leading to delays in processing and increased operational costs. Regulatory Compliance Risks: Operating in the financial sector meant that the client had to comply with a complex set of regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Their legacy systems lacked automated compliance checks, increasing the risk of non-compliance and potential penalties. Data Fragmentation: Customer account information, transaction histories, and financial reports were spread across multiple unconnected systems. This fragmentation made it difficult to generate real-time insights, track suspicious activity, or provide a seamless customer experience. Customer Experience Limitations: Users faced slow transaction times, inconsistent notifications, and limited visibility into their accounts. This negatively affected trust and reduced the overall adoption of digital banking services. The client’s team realized that without a comprehensive solution to these challenges, scaling the business while maintaining operational efficiency and regulatory compliance would remain extremely difficult.

Solution

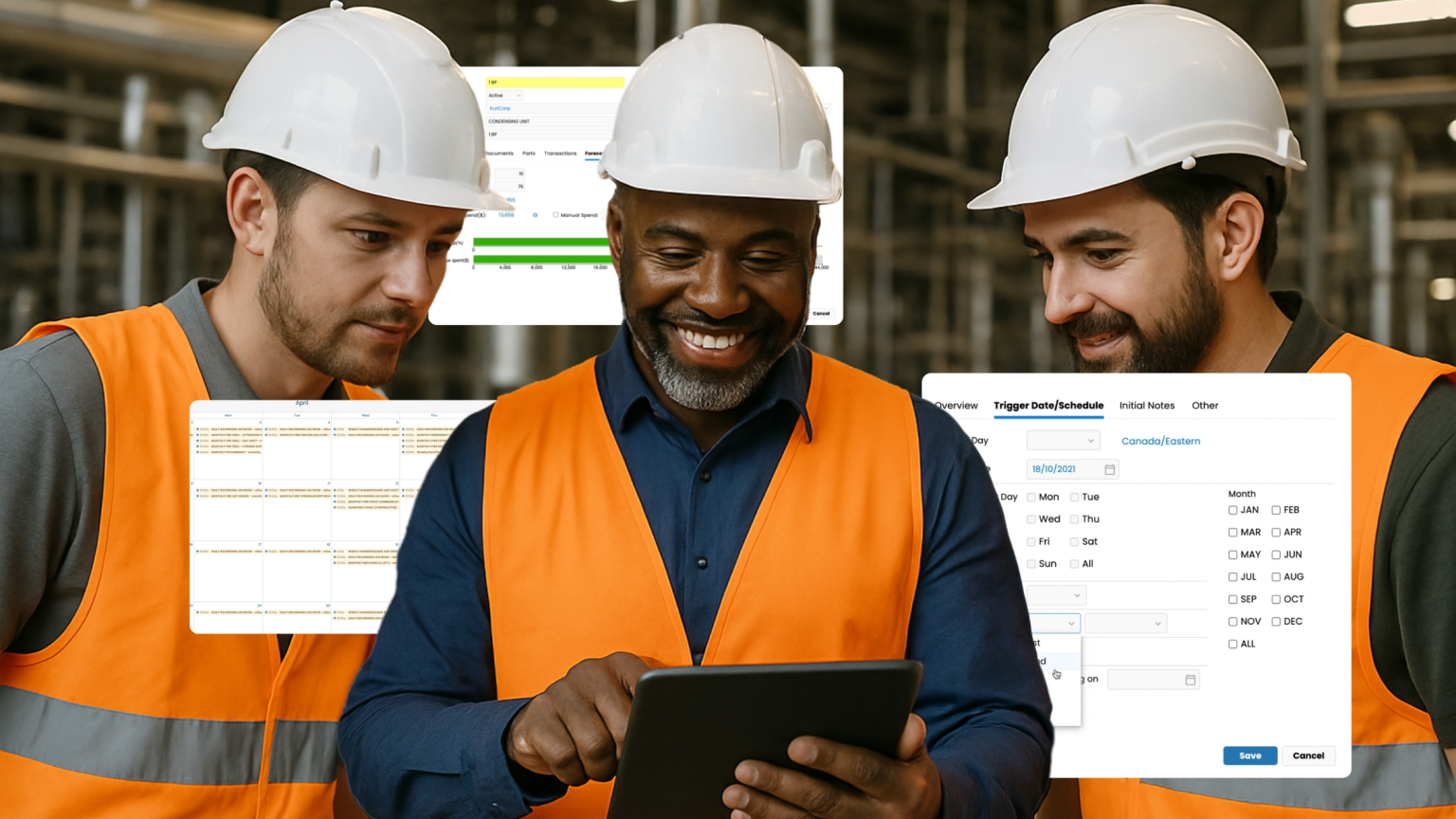

Koldatech implemented a custom Fintech Transaction & Payment Management Platform designed to optimize every aspect of the client’s financial operations. The solution was built with a focus on speed, security, compliance, and scalability.

Real-Time Transaction Processing: The platform was engineered to process transactions in real time across multiple channels, reducing delays and improving customer satisfaction. Payments, transfers, and bill settlements were automated to ensure speed and reliability. Automated Compliance & Risk Management: Regulatory compliance checks, including AML and KYC validations, were fully integrated into the workflow. The system automatically flagged suspicious activity, reducing manual oversight and mitigating regulatory risk. Fraud Detection: Advanced AI algorithms monitored transactions for unusual patterns, identifying potential fraud before it could impact customers. Alerts were sent to risk management teams for immediate review, ensuring proactive mitigation. Centralized Customer Dashboard: Customers gained access to a unified dashboard displaying account balances, transaction histories, pending payments, and alerts. This centralization improved transparency, streamlined navigation, and enhanced trust in the platform. Seamless Integrations: The platform connected with banking partners, payment gateways, and accounting systems, creating a fully integrated ecosystem that supported operational efficiency and scalability. By combining automation, AI-driven insights, and a user-centric interface, Koldatech’s platform enabled the client to address key operational challenges while preparing for future growth. Following the implementation of Koldatech’s platform, the client experienced significant improvements across all aspects of their operations: • 60% faster transaction processing due to automation and optimized workflows. • Improved regulatory compliance with automated AML and KYC checks, reducing the risk of penalties. • Enhanced fraud detection leading to safer transactions and stronger customer trust. • Streamlined operational efficiency through centralization of accounts, reporting, and reconciliation. • Scalable architecture that supports increased transaction volumes, new service offerings, and expansion into new markets. Koldatech’s Fintech Transaction & Payment Management Platform not only addressed the client’s immediate operational challenges but also positioned them for long-term growth. The client now provides faster, safer, and more reliable digital banking services to its customers, gaining a competitive edge in the market.

Key features

-

Secure Payment Processing

High-speed, encrypted transactions ensured the safety and integrity of all financial operations while minimizing downtime.

-

Automated Reconciliation:

End-to-end automation reduced manual errors and accelerated financial reporting, enabling more accurate and timely decision-making.

-

AI-Powered Fraud Detection:

The system detected anomalies in real time, alerting the compliance team and preventing potential losses.

-

Unified Customer Account Portal:

A single access point for users to manage accounts, view transactions, and receive alerts, significantly improving the user experience.

-

Analytics & Reporting:

Detailed dashboards provided real-time insights into transaction volumes, payment trends, risk profiles, and operational performance, supporting strategic business decisions.

YOU MIGHT ALSO BE INTERESTED IN...

Let’s Build Your Next Success Story

Ready to turn your idea into a powerful digital solution? KoldaTech is here to help. Contact our team to discuss your project, explore tailored solutions, and discover how we can deliver measurable results for your business—on time and at scale.